Bentonville, Ark. – Walmart U.S. in recent weeks has been capturing more business from middle- and higher-income shoppers. But they’re mostly sticking to the food and consumables aisles.

For the second consecutive quarter, general merchandise comp sales were down in the mid single digits, with particular softness in electronics, apparel and home products. The strongest categories were automotive, lawn & garden and back-to-school.

At Sam’s Club, the home and apparel division comped up in the low teens, led by strength in apparel, outdoor living, seasonal and toys.

Key merchandising takeaways from this morning’s Q2 call with investors:

Inventory clearance. At the close of Q2, inventory was down 15 percentage points, but Walmart is still working through excesses in electronics, home and sporting goods. “We’ve also canceled billions of dollars in inventory to align with anticipated demand,” said John David Rainey, EVP/CFO.

Selective investments. Merchants have reassessed demand on a sub-category by sub-category basis, cancelling orders in the process in some cases. Walmart Inc. president and CEO Doug McMillon said the company will still bet big on items it expects to pay off, citing Halloween inflatables as an example. “You don’t want to go into too much of a defensive mode,” he said.

Second half seasonal goods. Fall and holiday products are focused on newness and heavily tilted toward opening price points. “We expect inflation to continue to influence the choices families make,” said McMillon.

Looking ahead. The overall business at Walmart U.S. is much larger than it was in 2019. “Next year, we’ll see purchasing levels that are more in line with the way we see demand going in terms of the mix today,” said John Furner, president and CEO of the division.

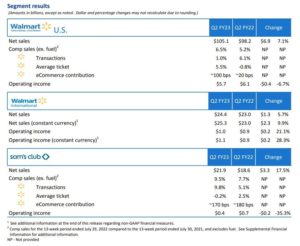

Total Walmart Inc. revenue for the quarter was $152.9 billion, up 8.4%, or 9.1% in constant currency. Operating income fell 6.8% to $6.9 billion.

See also:

- 3 reasons why Walmart now expects difficult terrain for general merchandise

- The Good, the Bad & the Ugly: Walmart | Warren Shoulberg

Editor-in-Chief Jennifer Marks shares news and views from around the home textiles marketplace.