Minneapolis – The era of major home makeovers seems to have ended for Target’s shoppers.

“Having already renovated their homes with purchases like furniture and small appliances, guests are now refreshing their homes with smaller touches, driving demand in categories like décor, candles and seasonal assortments,” said Christina Hennington, EVP and chief growth officer.

Although there was a small pullback in Q1 comps for the home department, sales were up 40% compared to the first quarter of 2019, she said during this morning’s call with investors. That marks $1.2 billion in category growth for the period.

As Target lapped the anniversary of the big federal stimulus payouts in spring 2021, the home, apparel and hardlines categories saw a rapid slowdown of year-over-year sales beginning in March. While some of that was expected, “we didn’t anticipate the magnitude of that shift,” said chairman and CEO Brian Cornell.

Overloaded with inventory – especially in bulky categories like kitchen appliances, TVs and outdoor furniture – Target has opted to cut prices as it works to right-size its assortments.

Although Target’s customers are worried about inflation and rising gas prices, they feel more positive about their personal finances, said Hennington. They’re still willing to splurge on items such as new shoes or accent pillows, she noted, and Q1 luggage sales shot up 50%.

As has been the case for every other retailer that recently reported quarterly results, Target’s bottom line was impacted by higher-than-expected freight and transportation as well the consumer pivot to spending more on food and essentials. The company does not expect global supply chain issues to begin smoothing out until early 2023.

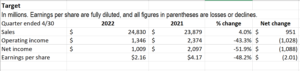

For the quarter ended April 30, sales growth was led by frequently-purchased categories, including food & beverage, beauty and household essentials. Comparable sales grew 3.3%. Store comparable sales increased 3.4%, on top of 18.0% growth last year. Digital comparable sales grew 3.2%, following growth of 50.2% last year.

Comp growth was fueled by traffic, which rose 3.9%.

“We’re still seeing healthy overall spending by our guest and meaningful spending around holidays,” said Cornell. “We’re getting ourselves back on track for a more normalized environment in 2023.”

Editor-in-Chief Jennifer Marks shares news and views from around the home textiles marketplace.