Photo by Ronan Furuta on Unsplash

The year isn’t getting started in quite the way we might have hoped for a few months ago. Nearly the entire winter/ spring trade show season has been shuffled around, with Las Vegas Market moving to April, Heimtextil moving to May and High Point moving to June. The New York Home Fashions Market will take place on schedule in March, but will once again occur as a virtual event.

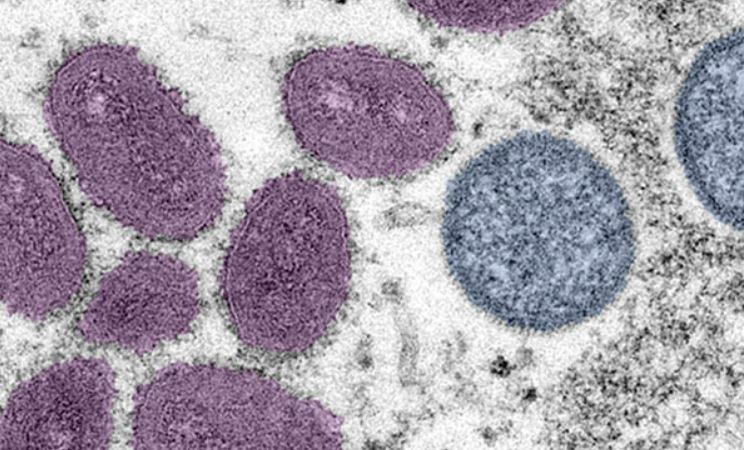

Although health officials predict a bleak season for COVID-19 cases over the first several weeks of the year, we don’t appear to be headed into massive retail shut-downs of the sort that upended the business in spring 2020.

Which is good because we’re still rebalancing in the wake of the permanent retail shutdowns caused by companies that never made it out of bankruptcy or those that are reducing their physical store footprints.

A few contours of “the new normal” are taking shape, though.

More e-commerce, fewer stores. Hundreds of stores were erased as part of downsizing initiatives even before the COVID era. More flushed out completely by the end of 2020, including Pier 1, Gordmans/Stage Stores and Stein Mart. E-commerce sales jumped during temporary store closures at the beginning of the pandemic, but share held at a higher rate even after brick & mortar reopened. According The NPD Group, online accounted for 29% of home textiles sales from July through September, up from 23% during the same period of 2019. Joe Derochowski, NPD’s president and home industry advisor, expects the number may settle for a little while, but will ultimately move up to 40% or maybe even 50%.

More suppliers going DTC. This one is a no-brainer for companies that already have significant drop-ship business, especially those with brands or brand-building know-how. There are quite a few that already have direct-to-consumer online businesses, although that segment doesn’t yet account for a major part of their sales. Others operated branded stores on Amazon Marketplace. We will surely see more.

The home focus gamble. The big question for everyone in the home furnishings industry is how long the consumer investment in home last. Making an accurate estimate is no small matter. Plan too conservatively and you wind up losing out on millions in business. Stock up too optimistically and you’ll be stuck with a lot of dead inventory once the bubble goes pop. Most major retail execs who were asked the question during their November/December quarterly calls said they expect the trend to carry through most of 2021.

Of course, it’s possible we’re already in the “new normal” given that the retail business is ever-changing and frequently buffeted by events beyond its control. Remember, it was only a year ago that tariffs seemed to be the biggest issue at hand. The industry will pull through. It always does.

Editor-in-Chief Jennifer Marks shares news and views from around the home textiles marketplace.