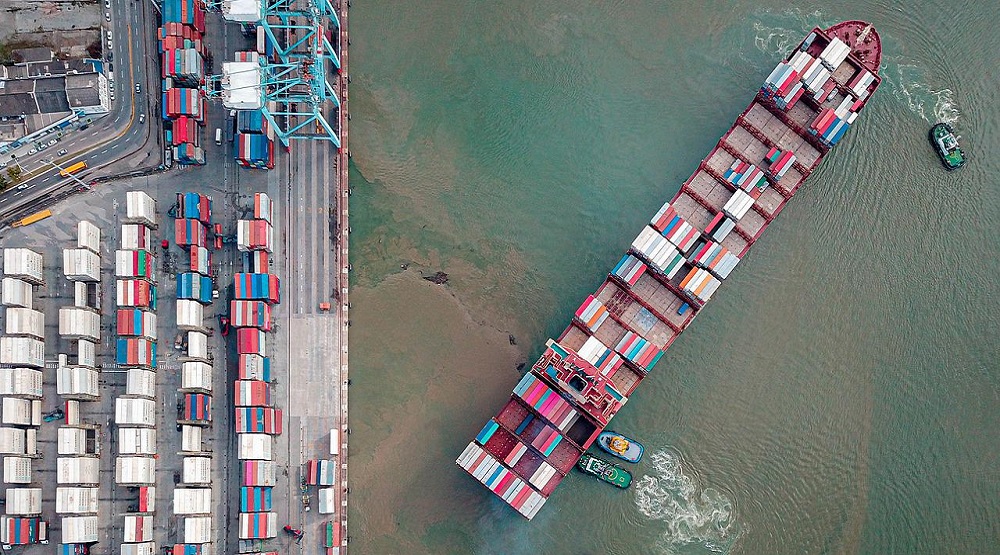

Photo of a container ship pulling up to a port.

Washington – According to the monthly Global Port Tracker report released today by the National Retail Federation (NRF), imports have set another record high this spring as the nation’s major container ports worked to reduce congestion and retailers stocked up before dockworkers’ West Coast labor contract expired.

“Cargo volume is expected to remain high as we head into the peak shipping season, and it is essential that all ports continue to operate with minimal disruption,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “Supply chain challenges will continue throughout the remainder of the year, and it is particularly important that labor and management at West Coast ports remain at the bargaining table and reach an agreement.”

The contract between the International Longshore and Warehouse Union and the Pacific Maritime Association expired July 1, but cargo operations are continuing at this time. NRF and more than 150 groups wrote to President Biden last week asking the administration to work with both sides to avoid disruption.

Ports saw a surge in activity this spring as a slowdown in cargo from Chinese factories closed by COVID-19 gave them a chance to clear built-up congestion. Retailers bringing in seasonal merchandise and importing other goods early to avoid any problems related to the contract negotiations may have also contributed to volume.

“Congestion of ships waiting to berth on the West Coast has eased, and we expect to see the same on the East Coast as carriers begin to return to their normal patterns of port calls,” said Ben Hackett, Hackett Associates’ founder. “After a short period of decline, freight rates are on the rise again as congestion in Europe and idle vessels there take capacity out of circulation.”

Prepared by Hackett Associates, the latest Global Port Tracker found that U.S. ports covered by the report handled 2.4 million twenty-foot equivalent units (TEU) in May, the latest month for which final numbers are available. That was up 6 percent from April and up 2.7 percent year over year. It also set a new record for the number of containers imported in a single month since NRF began tracking imports in 2002, topping 2.34 million TEU this March.

Ports have not yet reported June numbers, but Global Port Tracker projected the month at 2.25 million TEU, up 4.8 percent from the same month last year. That would bring the first half of the year to 13.5 million TEU, a 5.4 percent increase year over year.

Looking further forward, July is forecast at 2.31 million TEU, up 5.3 percent from last year, and would be the fourth-busiest month on record. August is forecast at 2.26 million TEU, down 0.5 percent year over year; September at 2.12 million TEU, down 0.8 percent; October also at 2.12 million TEU, down 4.1 percent, and November at 2.06 million TEU, down 2.5 percent.

The year-over-year declines during the second half of the year contrast with unusually high numbers during the same period in 2021, but volumes remain high, and the full year is still expected to see a net increase over 2021. Imports for all of 2021 totaled 25.8 million TEU, a 17.4 percent increase over 2020’s previous annual record of 22 million TEU.

MORE

It’s a ways off, but a longtime observer can see an ‘end game’ for ocean-shipping disruption

Ocean freight carriers made more money in 2021 than in past 20 years combined

Adelaide “Addie” Elliott is an associate editor focusing on retail coverage for Furniture Today and Casual Living. Previously, she also served as the web editor for both those brands and Designers Today. Before being promoted in May 2019 to web editor, Adelaide worked as Furniture Today’s editorial intern for a year. Get in touch with her on Twitter at @AElliott_Writes or by email at [email protected].