Designer Thom Filicia is one of several designers who have made their mark in the world of home furnishings.

By Leigh Ann Schwarzkopf

Licensing is thriving, and home-related businesses might want to take a fresh look at how the business model can help augment or continue to build their portfolios.

Worldwide, licensed merchandise rang up more than $315.5 billion at retail in 2021, according to Licensing International’s 2022 Global Licensing Industry Study, released last week. This total figure is up 7.7 percent from 2019. In the US/Canada region, licensed merchandise rang up $186.3 billion, an increase of 9.7 percent from 2019.

“Following years stuck inside because of the pandemic, the home décor and housewares categories are more important to consumers than ever. And considering their recent growth—data from the study shows that revenue for home décor grew 15.6 percent from 2019 to 2021, while revenue for housewares grew 19.1 percent during the same period—these categories will continue to be of significant interest to the global licensing industry moving forward,” said Maura Regan, president of the trade association Licensing International.

If you have a notion that licensing is concerned mostly with superhero or kiddie cartoon properties, you’re half right, yet simultaneously sorely mistaken when it comes to home-related goods purchased by consumers.

A quick look at the overall data indeed suggests that product enhanced with a character/entertainment property, such as those from tentpole movies or television shows, comprised 41% of sales of the $315.5 billion global pie. The Walt Disney Company’s empire alone amasses $56.2 billion in all types of licensed goods, according to an estimation made by the trade resource License Global in its annual Top Global Licensors report. For sure, it can be said that epic movie trademarks and cute characters dominate certain playgrounds in the licensed merchandise multiverse.

But drill down in the study to our business universe, the realm of manufacturing, merchandising, and marketing home-related products, and a different scenario emerges.

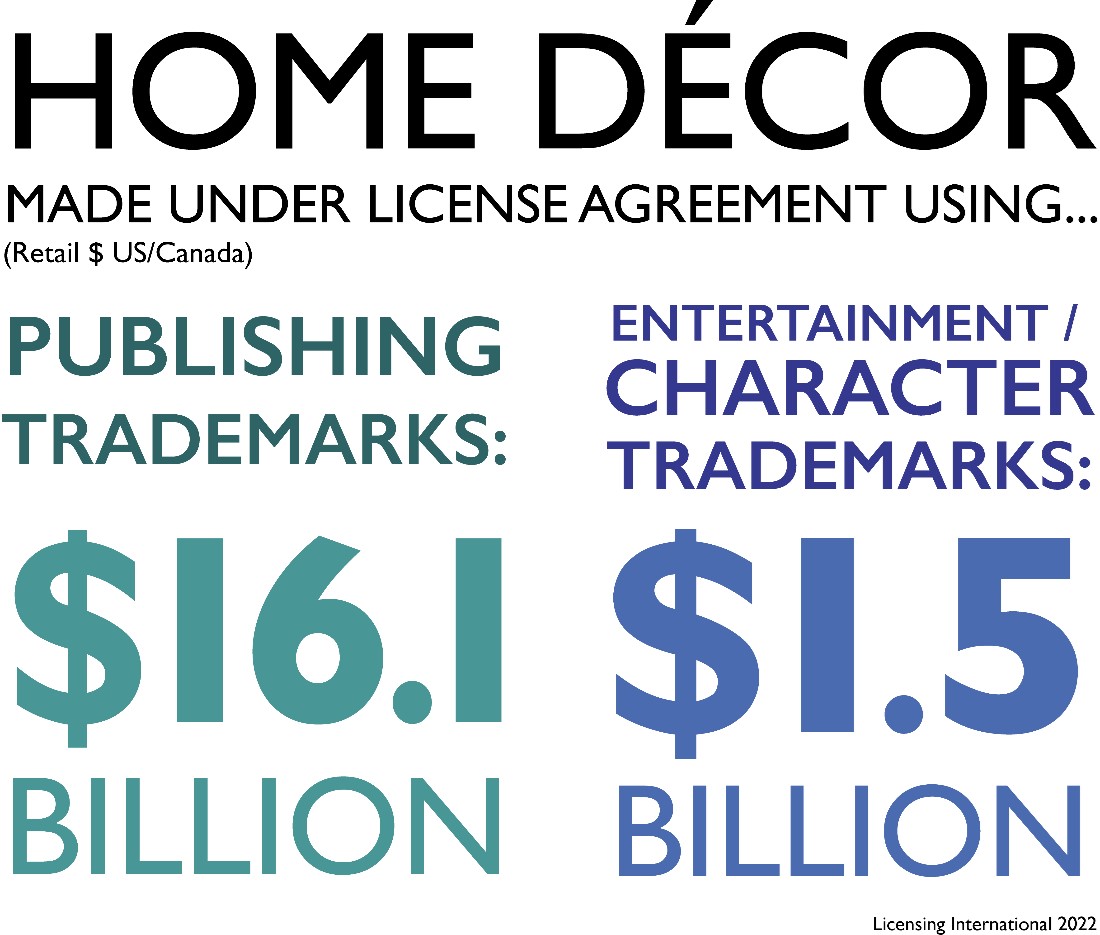

For example, in the realm of licensed home décor goods sold in US/Canada, a $20.7 billion segment in 2021, publishing-rooted properties out-performed entertainment/character brands, $16.1 billion to $1.5 billion.

Of note is multiple IP owner Dotdash Meredith, home of the 100-year-old magazine Better Homes and Gardens. Its merchandising program sprouted at Walmart’s gardening department 24 years ago, and has since branched into 3,000 SKUs, spanning bedding, bath, patio, furniture, kitchen and dining, decor, paint, wallpaper, and lighting. Other Dotdash titles like Southern Living and Coastal Living also have merchandising programs residing at Dillard’s and other chains. As if this didn’t prove the scale of the Dotdash’s presence in homes, the licensor’s Better Homes and Gardens Real Estate affiliation cements the publisher’s place as the number two largest global licensor, with $35.9 billion in sales, second only to Disney, according to License Global.

But back to our world: Dotdash isn’t the only publishing game in store. Hearst (Cosmopolitan, House Beautiful, and Country Living), Playboy, and Lagardere (Elle Décor) each execute merchandising programs in brick-and-mortar retailers and online.

Interior Designers Can’t Be Overlooked

“In home-interiors categories, licensing has a meaningful role, especially when an upscale interior design name is the property,” said trend expert Michelle Lamb, founder of The Trend Curve. “Licensed collections can become catalysts for new color or design trends. In other situations, licenses provide a unique story for manufacturers or retailers to tell, helping to make their products stand out from the rest.”

Examples of interior designers who’ve made their mark as licensors within home décor include Alexa Hampton, Thomas O’Brien, Barbara Barry, Barclay Butera, and Kim Salmela.

“What Kim Salmela brings to us is an aesthetic that is fresh and unique, but not too far from our Norwalk key collections,” said Dixon Bartlett, chief creative officer, Norwalk Furniture, which has held the license since 2018. “Each season her designs have grown from the previous show, as our dealers become increasingly comfortable with her more casual West Coast vibe, and most importantly, as her key SKUs prove themselves to be winners at retail. Our dealers do talk to each other and when a few key dealers get behind any new design, it can have a very positive sales effect, as other possibly less risk-averse dealers become willing to stretch their aesthetic. For sure this has been the case with Kim’s designs, and why our partnership with her is strong and important to Norwalk.”

Other manufacturers echo the benefits of securing the right license for their business. “Our licensed brands, specifically Tommy Bahama (Home and Outdoor Living) and Barclay Butera have seen steady growth each year. These brands continue to prove their relevance in the home furnishings industry,” said Shannon Baugh, marketing manager for Lexington Home Brands. “We support this growth by adding to their portfolios with unique lifestyle collections on a regular basis. Each brand reflects significant diversity, while maintaining its core inspiration, adding to the overall appeal and strength of its name.”

In the $4.6 billion retail sales category of licensed housewares, corporate trademark properties outpaced those of character/entertainment properties, $2.2 billion to $639 million. Products manufactured under license from century-old, established household brands, such as KitchenAid bakeware and Maytag steam irons (both brands owned by Whirlpool), for example, seem to resonate more often with shoppers than character-laden merchandise does. Other venerable brand owners with licensed stakes in the housewares aisles: Frigidaire (owned by Electrolux), Braun and VICKS (owned by Procter & Gamble), and Arm & Hammer (from Church & Dwight), to name a few.

According to Licensing International’s analysis included in its latest research, “Words like nesting, “pantrying,” and home cooking took on a whole new meaning as the world adjusted to life at home in 2020 & 2021. Licensed product category focus clearly shifted with the times as respondents commented on the strong focus on the home décor, housewares, and food & beverage categories by the pandemic consumer.”

Gift-giving shoppers prefer character/entertainment properties slightly more than other types of trademark owners, the Licensing International study suggests. Within this $5.3 billion licensed goods gifts segment in the US/Canada, character/entertainment trademarks comprised $1.6 billion in sales, while sports licensors followed with $1.4 billion, and corporate trademark brands with $1.3 billion.

In the category of Lawn/Garden Tools/Hardware, there were two standout licensor-types raking in the majority of the $6.9 billion in retail sales of licensed merchandise sales in US/Canada. Publishing was king with its $4.2 billion pile, perhaps thanks to properties such as Dotdash’s Better Homes and Gardens expansion into heaters and bath hardware at Walmart, and its Southern Living line of branded plants, shrubs and trees at national DIY centers in the southeastern US. Also, Hearst’s House Beautiful partnered with Frontgate to co-design and curate three indoor and outdoor home furnishing collections, according to License Global.

The second most prevalent property was corporate trademarks, which amassed $1.6 billion. Licensors living in this category include hardware brands such as Stanley/Black and Decker, Goodyear, Roto-Rooter, and Rust-Oleum. Much like housewares, this product category of Lawn/Garden Tools/Hardware also gained more than 19% in global licensing revenue from 2019, the data suggests.

Building a resilient business in today’s market requires exploring many ways to reach consumers. Licensing can help achieve those goals as is demonstrated by the robust performance at retail.

Leigh Ann Schwarzkopf is the founder of Project Partners Network, which offers extensive experience and top management-level expertise in all areas of licensing.

More on brands:

Macy’s Hotel Collection co-brands with luxury boutique inns on new home line

Target’s partnership with social media phenom migrates from apparel into home